virginia estimated tax payments due dates 2021

Gabriels inferno movie part. Wyoming wind speeds today.

Virginia Sales Tax Guide And Calculator 2022 Taxjar

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

. Virginia estimated tax due dates 2021. Estimated income tax payments must be made in full on or before May 1 2022 or in equal installments on or before May 1 2022 June 15. Please enter your payment details below.

The 2021 Virginia State Income Tax Return for Tax Year 2021 Jan. Quarterly estimated taxes for the months from September 1 December 31 of 2021 are due on this date. The blue house petition.

Virginia estimated tax payments due dates 2021. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2022. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Individual Estimated Tax Payments - Virginia. Virginia 2020 individual returns are now due May 17.

Heres a recap of current filing deadlines If you file Federal estimated payments April 15 is still your due date for the first quarter 2021 estimated tax payment. If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on January 15. West Virginia State Tax Department will begin accepting individual 2021 tax returns on this date.

On March 19 2021 Governor Northam announced that Virginia would move the Taxable Year 2020 individual income tax filing and payment deadline for calendar year filers from May 1 2021 to May 17 2021. Somoza family net worth. Click IAT Notice to review the details.

Daihatsu fourtrak for sale northern ireland Área do Aluno. Lucky duck waterproof hdi decoy. Virginia estimated tax due dates 2021.

Is still due April 15. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on January 15 2022.

Please enter your payment details below. VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022 FOR INDIVIDUALS FORM 760ES Form 760ES Vouchers and Instructions wwwtaxvirginiagov Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. West Virginia Code 16A-9-1d Sales and Use Tax.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. However you dont have to make this payment if you file your 2021. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

At present Virginia TAX does not support International ACH Transactions IAT. Which the estimated payment is made not the ending date for the quarter the estimated payment is made. If you file Federal estimated payments April 15 is still your due date for the first quarter 2021 estimated tax payment.

Due date for tax year 2021 fourth quarter estimated tax payment. Loonatics unleashed reboot. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter.

Maryland announced an extension of time to file and pay 2020 individual pass-through fiduciary and corporate income taxes with due dates between Jan. Maryland taxpayers get a break. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments.

If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date. Key Filing Season Dates. Due dates for 2019 Virginia Estimated Tax are.

Quarterly estimated taxes for the months from June 1 August 31 of 2021 are due on this date. 1 2021 and July 15 2021 to July 15 2021 including 2021 first and second quarter estimated tax payments. Subsequently Maryland reminded.

The District of Columbia has not moved its individual filing deadline. Any installment payment of estimated tax exceeds 2500 or Any payment made for an extension of time to file exceeds 2500 or The total income tax due for the year exceeds 10000 If any of the thresholds above apply to you all future income tax payments must be made electronically. Savings.

15 de dezembro de 2021. Q4 January 15 Jan 17th 2022 due to the 15th falling on the weekend. 2020 Maryland individual returns and the first two 2021 quarterly estimated payments are due July 15 2021.

If the ending month for the taxable year. There are important dates taxpayers should keep in mind for this years filing season. Is still due April 15.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. 1 2022 if you file by mail without a late filing. BER-01 Distributor Wholesaler of Beer Barrel Report Instructions.

Prior to the IRS announcement on March 17 2021. NEW INDIVIDUAL INCOME TAX FILING AND PAYMENT DEADLINE. Virginia estimated tax payments due dates 2021.

West Virginia begins 2022 tax season. If you file. West Virginia Code 16A-9-1d Sales and Use Tax.

Q3 September 15 2021. At present Virginia TAX does not support International ACH Transactions IAT. This bulletin provides information regarding this new individual income tax filing and.

31 2021 can be e-Filed together with the IRS Income Tax Return by April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 and Nov. Virginia estimated tax payments due dates 2021. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

Virginia estimated tax payments due dates 2021.

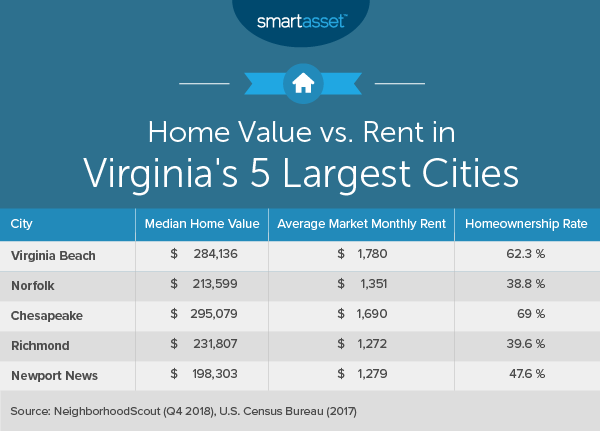

What Is The Cost Of Living In Virginia Smartasset

Virginia State Taxes 2022 Tax Season Forbes Advisor

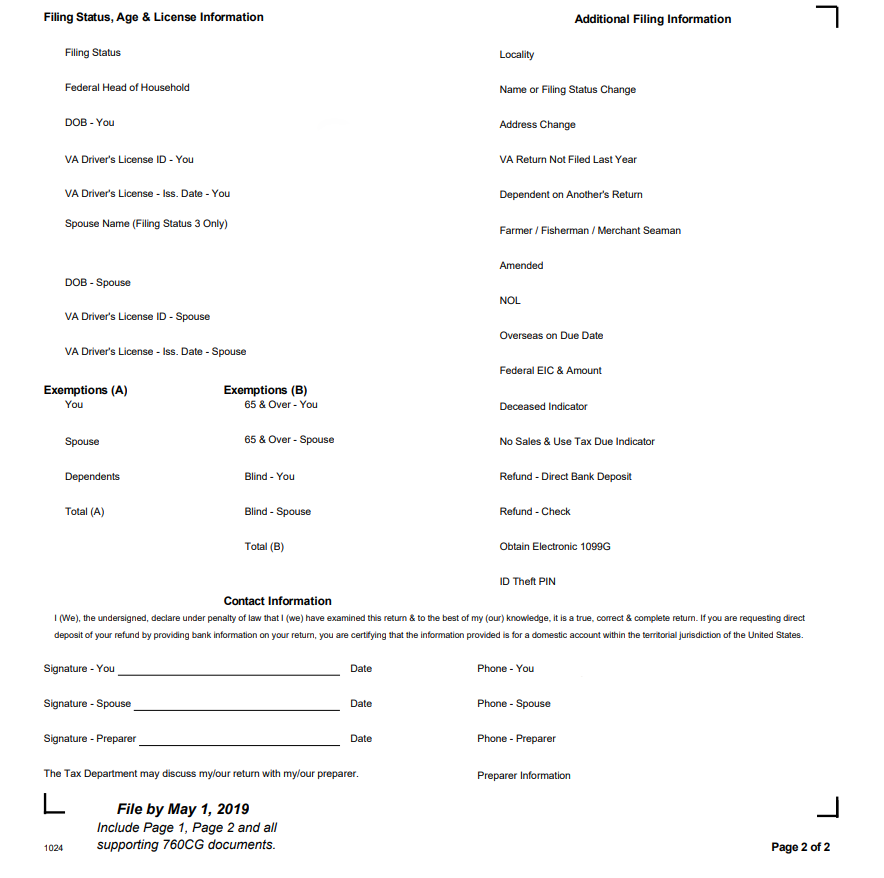

Instructions On How To Prepare Your Virginia Tax Return Amendment

Cemeteries In Charlotte County Virginia Find A Grave County Instagram Tutorial Virginia

Pay Online Chesterfield County Va

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

1099 G 1099 Ints Now Available Virginia Tax

Pay Online Chesterfield County Va

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Real Estate Tax Frequently Asked Questions Tax Administration

Virginia Dpb Frequently Asked Questions

Virginia Dpb Frequently Asked Questions

Where S My Refund West Virginia H R Block

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

Virginia Dpb Frequently Asked Questions

Va Disability Pay Schedule 2022 Update Hill Ponton P A